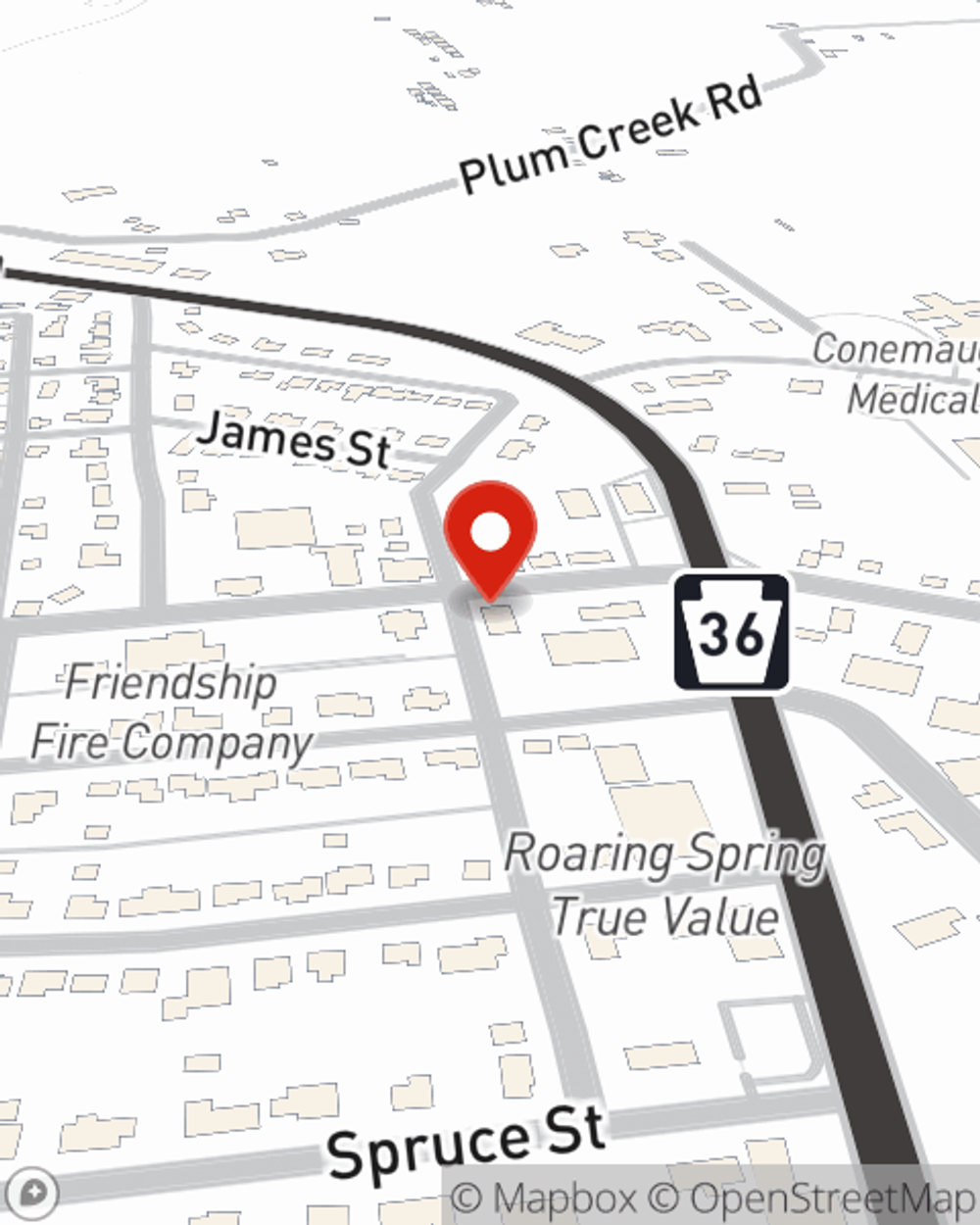

Business Insurance in and around Roaring Spring

Searching for insurance for your business? Look no further than State Farm agent Kirk Pyle!

Helping insure small businesses since 1935

Coverage With State Farm Can Help Your Small Business.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like errors and omissions liability, a surety or fidelity bond and extra liability coverage, you can take a deep breath knowing that your small business is properly protected.

Searching for insurance for your business? Look no further than State Farm agent Kirk Pyle!

Helping insure small businesses since 1935

Strictly Business With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Kirk Pyle for a policy that safeguards your business. Your coverage can include everything from worker's compensation for your employees or errors and omissions liability to employment practices liability insurance or professional liability insurance.

Get right down to business by visiting agent Kirk Pyle's team to talk through your options.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Kirk Pyle

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.